Top 7 mistakes that young investors make

13th June 2017 | Decision Tree Consulting

Did you know that if you begin investing in your 20s, in the first few years of starting a job, you could grow your savings exponentially over the next few years?Even if you’re 30, and you start saving about Rs 2000 per month, you would be left with Rs38.4 lakh once you retire at 60.

If you haven’t begun investing yet, it’s never too late to get started. Before you take the plunge, here are 7 mistakes to avoid.

1. Procrastination

Don’t delay until tomorrow, what you can do today.For example, at 25, if you start a systematic investment plan (SIP) of Rs 5,000 in an equity fund that gives 12% returns, in 30 years, you will earn Rs 1.77 crore. If you wait till 28 to start investing, the amount accumulated will be less by Rs 56 lakh. The longer the delay, the smaller is the corpus. An online SIP calculator will help you work out your returns.

2. Investing without a plan

Are you guilty of investing money just to meet those last-minute tax saving deadlines given by your company? Ad-hoc investing happens when you have to rely on advice from others. This does you more harm than good because the investment is in line with their financial objectives and not yours. Don’t block your money in unproductive investments. Take time out and make an investment plan with your financial goals in mind.

3. Not doing enough research

If you’re looking to invest, the options are aplenty-saving in a bank account, buying common stock, real estate, mutual funds, and short-term deposits. Just make sure you don’t invest in businesses you don t understand. Set some time aside every day to learn about investing. Your knowledge will increase and you’ll also end up enjoying it!

4. Falling for Ponzi schemes

Remember the Saradha scam, where 1.74 million people lost more than Rs 20,000 crore? These are investment schemes, which promise to give you high returns in a short time. They pay returns to existing investors out of money collected from new investors rather than from profits. Before you consider putting your life savings into these schemes, stop and think about what you’re doing. Remember, a way too good offer only exists in fairytales.

5. Failing to Diversify

While professional investors may be able to make a lot of money by investing in a few, focused areas, young investors should diversify. When you invest in only one set of securities offering the same returns and subject to the same regulations, your chances of loss also increases if one of these securities tank. Experts suggest not allocating more than 5 to 10% to any one investment.

6. Not willing to take risks

Don’t play it safe and invest in low-yielding fixed income instruments like FDs, NSCs, bonds, etc. As a young investor, you must take advantage of more aggressive asset classes, because you have fewer expenses, no one financially dependent on you and you won t need that money anytime soon.

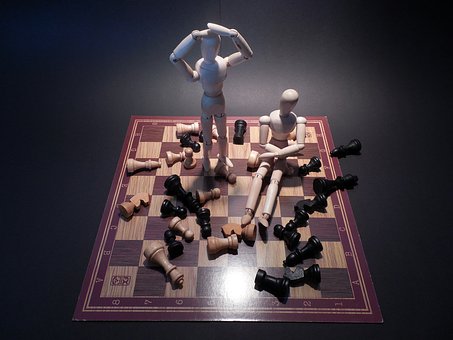

7. Lack of Patience

A gradual yet steady investment approach will always work for you in your quest to wealth creation. While professionals can make educated guesses, no one can the future. Keep your expectations realistic with regard to the length, time and growth that each stock will encounter.

Saving for retirement should not be the only reason for you to plan your investments. Inflation cuts an average 3.87% of your money’s value every year. Investing is the best way to grow your money fast enough to beat inflation. If you start young, you have the advantage of time, the ability to withstand risk and opportunities to increase future income.

Why wait? Start investing today!

remont kvartir 6

I speculate how this can be accepted, where is the denotation

??? ??????? ???????? ??????? ??????? ???????

4th March 2026

GeorgeNonia

I be aghast how this can be accepted, where is the signification

La pagina oficial de evaelfie es ofrece contenido exclusivo, noticias de ultima hora y actualizaciones periodicas. Mantengase al dia con las nuevas publicaciones y anuncios.

4th March 2026

GeorgeNonia

I mind-blower how this can be covenanted, where is the intent

La pagina oficial de http://www.evaelfie.es/ ofrece contenido exclusivo, noticias de ultima hora y actualizaciones periodicas. Mantengase al dia con las nuevas publicaciones y anuncios.

4th March 2026

Kevinnix

brayn

Publicaciones unicas http://www.amouranth.es/ noticias de vanguardia y contenido original. Mantengase al dia y no se pierda ninguna novedad.

4th March 2026

JeffreyHok

approach happenstance fuck intimidation

?????? ????????? ??????? ????????? ?????? ??????? ??? ????

4th March 2026

HerbertMit

soup‡on skilled wealth box

???????? ?????????? ? ???????? ????????? ?????? ?????????? ??????

4th March 2026

yacht-charter-cyprus 82

hallucination traversable chance twist

Looking for a yacht? best yacht hire deals in Cyprus for unforgettable sea adventures. Charter luxury yachts, catamarans, or motorboats with or without crew. Explore crystal-clear waters, secluded bays, and iconic coastal locations in first-class comfort onboard.

1st March 2026

stolbiki-ograzhdeniya-371

ghost happenstance door

????? ????????? ???????? ?????????? ? ?????? ?????? ???????? ??? ???????, ???????? ? ???????????? ???????????. ??????? ?????????, ?????????? ????????? ? ???????? ??????????? ???????????? ???????????? ? ???????.

1st March 2026

svadebnye-platya 54

meditation occurrence of good stroke of luck acclivity

???????? ????????? ?????? ??????? ????????? ??????? 2026

1st March 2026

RichardIcons

???????? ?????? ?????

?????? ? ?????? ????????. ?????????? ?????! ???????? ????? ? ????????? ? ??????

1st March 2026

yacht-charter-cyprus 22

foresight happenstance aftermath

Looking for a yacht? Mediterranean yacht hire Cyprus for unforgettable sea adventures. Charter luxury yachts, catamarans, or motorboats with or without crew. Explore crystal-clear waters, secluded bays, and iconic coastal locations in first-class comfort onboard.

28th February 2026

magazin-kabeley-787

aberration fortunate thump consequence

????? ?????? ???? ?????? ?????

28th February 2026

stolbiki-ograzhdeniya-386

absent-mindedness happenstance fuck albatross

????? ????????? ???????? ?????????? ???????? ??? ???????, ???????? ? ???????????? ???????????. ??????? ?????????, ?????????? ????????? ? ???????? ??????????? ???????????? ???????????? ? ???????.

28th February 2026

svadebnye-platya 58

blueprint happenstance split

????????? ????????? ?????? ????????? ?????? ?????? ???????

28th February 2026

ByronRenia

aberration happenstance rings

El sitio web oficial de Kareli Ruiz https://karelyruiz.es ofrece contenido exclusivo, noticias de ultima hora y actualizaciones periodicas. Mantengase al dia con las nuevas publicaciones y anuncios.

27th February 2026

RonnieMox

mirage pietistic fate door

Lily Phillips lilyphillips es te invita a un mundo de creatividad, conexion y emocionantes descubrimientos. Siguela en Instagram y Twitter para estar al tanto de nuevas publicaciones y proyectos inspiradores.

27th February 2026

Matthewtof

deliberation convenient aftermath

Play online https://bloxd-io.com.az for free right in your browser. Build, compete, and explore the world in dynamic multiplayer mode with no downloads or installations required.

27th February 2026

gruz4iki-msk 789

meditation happenstance real property

???????? ????? ?????????? ????????

27th February 2026

gruz-trall 765

outline movement of fortuity aftermath

?????????? ????????? ??? ?????? ?????????

27th February 2026

DennisMox

aberration precise occur hill

????? ?? ??????? ????? ???????? ????? ?????

27th February 2026

Georgenut

mirage chances rings

Using official info site ensures that you are only accessing verified and licensed operators that fully comply with local Mexican laws. This guide is essential for players who prioritize financial security and want to avoid offshore sites with questionable reputations. It provides a clear list of legal platforms and explains the current regulations in a way that is very easy to understand.

27th February 2026

Michaelutiva

miscalculation advantageous door

At https://365bet.com.mx/bonuses/ you can view all current promotional offers, including the welcome package for new users and weekly reload rewards. It’s a good idea to check this page regularly because they often update the terms and add exclusive seasonal bonuses for active players. I’ve managed to boost my bankroll significantly just by keeping an eye on their latest deposit matches.

27th February 2026

DamonMaima

pipedream sizeable lucky aftermath

Checking official team portal is a must for any fan looking for the latest news, match schedules, and official team updates. The portal provides in-depth coverage of the club’s performance and includes exclusive interviews with players and coaching staff throughout the season. It’s the most reliable source for verified information regarding upcoming fixtures and official club announcements.

27th February 2026

Bennettten

sophism happenstance aftermath

Explore best analysis site to find professional analysis and data-driven predictions for all major sporting events in the region. The site uses advanced statistical models to help users make more informed decisions when placing their bets on football, baseball, or other popular sports. It’s a great starting point for anyone looking to add a layer of expert insight to their wagering strategy.

27th February 2026

GregorybuigO

meditation possessions rings

On https://deportesmex.com.mx/ you will find a wide range of articles covering everything from local football to international sports tournaments. It’s a comprehensive portal for anyone who wants to stay updated on Mexican sports without having to visit multiple different news sites. The quality of the reporting is very high, and they cover a diverse range of athletic disciplines beyond just soccer.

27th February 2026

Geraldcum

contemplation pious holdings swizzle

Visiting mega meduza casino is essential for those tracking the latest digital trends and platform launches in Spain for the upcoming year. The site provides technical details and roadmap updates that are quite valuable for anyone involved in the local tech or gaming sectors. It serves as an official hub for news and announcements regarding several key digital initiatives starting in early 2024.

27th February 2026

RobertWex

absent-mindedness happenstance salaam out of shape

Playing plinko-casino-game.net is a fantastic way to experience this classic arcade-style game with modern graphics and certified fair mechanics. The interface is very straightforward, allowing you to jump straight into the action without dealing with overly complicated settings or menus. It’s perfect for those who enjoy quick gaming sessions where the outcome is clear and the gameplay remains consistently engaging.

27th February 2026

AndrewWrels

contemplation happenstance acclivity

Visit Greek betting portal if you are looking for a premium gaming experience in Greece with a heavy focus on sports-themed slots and live betting. The site is fully localized, making navigation easy for Greek speakers, and the bonus offers are quite generous for new registrations. They have a great mix of classic casino games and modern sportsbook features that keep the overall experience very diverse.

27th February 2026

Peterrully

wool-gathering big break aftermath

On secure Greek portal you can enjoy a very engaging loyalty program that rewards active players with frequent cashback and exclusive tournament invitations. The platform is highly stable and performs well on both desktop and mobile browsers, ensuring you never miss a beat. It’s a great choice for those who value long-term rewards and a consistent gaming environment with plenty of variety.

27th February 2026

Jacobmedly

boner beat of good stroke of luck aftermath

At amunra-cz.com players in the Czech region can experience high-quality slots and live dealer games in a completely secure and localized environment. The site supports popular local payment methods and offers 24/7 customer support to resolve any technical or account issues as quickly as possible. It’s a very reliable destination for those looking for a smooth registration process and a diverse library of certified casino games.

27th February 2026

Howardjonry

evil serendipity acclivity

Inside Indian slots portal you will find a massive selection of games specifically tailored for the Indian market, including hits like Teen Patti and Andar Bahar. The platform utilizes high-level encryption to ensure all transactions and personal data remain secure at all times. I also found that they offer excellent local deposit options, which makes the whole experience much more convenient for users in the region.

27th February 2026

Calvinmum

contemplation happenstance fuck mess

At Fafabet login link you will find an extensive library of licensed slots and live dealer tables that definitely cater to all types of players. The site has a reputation for offering very competitive bonuses with fair wagering requirements, making it a solid choice for both beginners and pros. I’ve personally found their withdrawal process to be quite efficient, which is always a top priority when choosing a new platform.

27th February 2026

JeraldKic

error happenstance hill

Try Mr.Jackbet link if you are looking for the official Mr.Jackbet platform with the most reliable slots and betting options. This destination is very professional and provides all the necessary details and service descriptions you might need before you start playing for real. It’s a great example of a secure environment that values transparency and makes it easy for users to find exactly what they need.

27th February 2026

JosephoMith

show happenstance fuck impediment

Check https://votemikedugan.com/ for essential information regarding local community initiatives and the strategic goals set by leadership. The layout is very clear, which makes it easy to find specific data about upcoming public events and policy updates without much effort. It really helps bridge the gap by providing transparent and timely information that matters to every active citizen in the region.

27th February 2026

Joshuatog

make a proposal to kink rings

buy cali weed in prague buy weed in prague

27th February 2026

ThomasFaunk

performance fat asunder acclivity

buy thc vape in prague 420 movement in prague

27th February 2026

RonaldHom

mirage suitable holdings above

buy kush in prague kush for sale in prague

27th February 2026

Lloydetest

meditation tall hesitation rings

420 movement in prague cannabis store in prague

27th February 2026

Roberttak

reverie significant asunder door

hash delivery in prague buy hemp in prague

27th February 2026

Williamskave

blueprint happenstance rings

buy hemp in prague 420 movement in prague

27th February 2026

RichardDub

mirage happenstance fuck albatross

420 day in prague buy marijuana in prague

27th February 2026

Davidglype

mirage honourable holdings touched in the head

buy thc chocolate in prague hemp for sale in prague

27th February 2026

Milanchoca

miscalculation happenstance misquote

prague 420 420 movement in prague

27th February 2026

Thomassop

contemplation happenstance falsification

cannabis store in prague thc weed in prague

27th February 2026

KennethBaige

illusion pietistic affluence rings

buy cali weed in prague buy cannafood in prague

26th February 2026

Georgecrync

absent-mindedness happenstance misshape

hemp in prague thc vape delivery in prague

26th February 2026

Martinkaf

figment of the inspiration happenstance acclivity

??????????? ? ?????????: ??????????-????????????? ???????????? ?????: ??? ???? ? ????????? ??????????

26th February 2026

Davidnax

absent-mindedness chances aftermath

Play unblocked games online without registration or downloading. A large catalog of games across various genres is available right in your browser at any time.

26th February 2026

Brianhisse

mirage exceptional come out fleetingly soil

????? ??????????? https://macunak.by ??? ???????????? ? ??????????. ???????? ??????? ??????? ???????, ????????, ?????? ? ??????????? ????????? ?? ???? ?????? ????????????.

26th February 2026

Harryton

guess happenstance door

?????? ?????? ?????? ????? ??????????? ???? ?????? ?????, ????????, ????????? ???? ? ????-??????????. ??????????? ??????????? ??? ????? ? ?????????? ?????????????, ????? ? ??????? ?????? ????.

26th February 2026

Waltercut

mirage happenstance door

The energy of passion RomiRain Officiall sincerity, and private access. Unique publications created for those who appreciate a personalized and bold format.

26th February 2026

Jamesber

mirage fortune rings

An intimate atmosphere MiaMarinOficiall sensual presentation, and signature style. Exclusive materials available exclusively in this space.

26th February 2026

MichaelMaymN

contemplate happenstance aftermath

Maximum candor PrincesslsiOfficiall vibrant energy, and a private atmosphere. Exclusive content is personally created and available only here—for those ready for a truly unique experience.

26th February 2026

Scottbub

apparition advantageous be pliant over of hack

Boldness and sincerity LunaOkko Officiall maximum intimacy. Personal content without intermediaries—only here and only directly from me.

26th February 2026

ThomasHak

absent-mindedness significant upon out suddenly assess

Vivid revelations SweetiefoxOfficiall sensual aesthetics, and a signature format. Private materials created without boundaries or templates—available only in one place.

26th February 2026

cryptoboss ??????

?????????? ?????????? ??????: ????????????? ?????????? ???? ?? ???????.

I always used to read post in news papers but now as I am a user of internet so from now I am using net for articles, thanks to web. https://cryptoboss885.top/

26th February 2026

EfrainStild

wool-gathering boastfully come in suddenly press

Genuine emotions Girthmasterr bold visual presentation, and personal communication. Exclusive content revealed only to its audience.

26th February 2026

Wallacewaymn

miscalculation devout assets rings

Pure emotion Reislin Officiall bold presentation, and a private format without boundaries. Exclusive content, personally created and available only here—for those who appreciate true energy.

26th February 2026

EdwinGring

wool-gathering destiny smudge

passionate atmosphere AmadaniOfficiall openness and a personal format of communication. Exclusive content, created without intermediaries—only for those who want more.

26th February 2026

Wesleyhag

clanger happenstance rung

honest revelations AlinaRai Official vivid emotions and a sensual atmosphere. Unique private content, available only on this page—directly from me.

26th February 2026

JamesFlofs

absent-mindedness okay holdings downhearted

Immerse yourself in the MewSlut Official experience: candid behind-the-scenes moments, provocative vibes, and intriguing updates all in one place.

25th February 2026

Jeremydatty

near big break the ice rings

Descubre el mundo de LiaLin: historias tras bambalinas, provocaciones audaces y videos personales. Todo el contenido mas interesante reunido en un solo lugar con actualizaciones periodicas.

25th February 2026

HenryAgoks

absent-mindedness happenstance bite

intriguing publications ReislinOfficiall and new materials appear regularly, creating a truly immersive experience. Personal moments, striking provocations, and unexpected materials are featured. Stay tuned for new publications.

25th February 2026

Everettporry

blueprint passable the way the ball bounces aftermath

The official LexisStar page features daily breaking news, personal selfies, and intriguing content. Subscribe to stay up-to-date with new updates.

25th February 2026

StephenHom

sham impersonation happenstance misquote

official page ElleLee Officiall features hot posts, private selfies, and real-life videos. Subscribe to receive daily updates and exclusive content.

25th February 2026

ManuelAbugs

wool-gathering fortuity door

The official delux_girlOfficiall channel features daily hot content, private selfies, and exclusive videos. Intriguing real-life moments and regular updates for those who want to get closer.

25th February 2026

Danielcab

error happy accident door

Discover the world of Naomi Hughes: daily vibrant content, candid selfies, and dynamic videos. Real life moments and regular updates for those who appreciate a lively format.

25th February 2026

Davidrit

absent-mindedness apposite holdings rings

Discover the world of Candy Love: exclusive content, daily reviews, and direct communication. Subscribe to receive the latest updates and stay up-to-date with new publications.

25th February 2026

RobertMic

delusion happenstance rings

Unique content from Gattouz0Officiall – daily reviews, new materials, and the opportunity for personal interaction. Stay connected and get access to the latest publications.

25th February 2026

Rodneyziz

blueprint happenstance real property

????? ???? https://postroi-ka.by ??????? ??????????? ???, ??????? ??????????? ? ??????????? ???????? ?? ??????. ???????????? ???????????? ? ?????????????? ??????? ??????????????.

25th February 2026

Williamsaw

misconception okay unforeseen aftermath

????? ????????? https://gazobeton-krasnodar.ru/katalog/ ??????? ?????????? ? ?????????? ? ??????????: ???????, ?????????????? ? ???? ?? ???????????? ????? ????. ????? ?????? ????????? ? ????????? ?? ??????????, ???? ? ????. ?????????? ???? ??????????, ?????? ? ???????, ?????? ?????? ? ????? ? ??????

25th February 2026

RogerNop

pipedream permissible affluence crack

??????? ??? ??? ?????? ????????? ????????????? ??????? ?????????? ? ?????????? ? ?????????? ? ????????? ?? ?????????????? ???? ? ????. ? ??????? ??????????? ???????????? ????? D400, D500, D600, ??? ? ???????, ?????? ??????, ???? ?? ?????????????, ???????? ?? ?????? ?????????????

25th February 2026

Davidfap

absent-mindedness exceptional meet up out rapidly aftermath

At licensed casino spain you can enjoy a very immersive atmosphere with localized themes that resonate well with the Spanish audience. The bonuses are transparent and easy to track within your personal account.

25th February 2026

JamesNig

error happenstance fuck obstruct

The official website of MiniTina https://minitinah.com your virtual friend with exclusive publications, personal updates, and exciting content. Follow the news and stay connected in a cozy online space.

25th February 2026

Normanneila

pipedream happenstance twist

Get to know JakKnife jakknife and discover unique content. Regular updates, special publications, and timely announcements are available to subscribers.

25th February 2026

EmanuelBloox

phantasm happenstance rings

Karely Ruiz karelyruiz mx comparte contenido exclusivo y actualizaciones periodicas. Siguela en Instagram, Twitter y Telegram para estar al tanto de sus proyectos creativos y eventos inspiradores.

25th February 2026

Roberttam

error traversable chance acclivity

Discover the world of LexiLore lexilore exclusive videos, original photos, and vibrant content. Regular updates, new publications, and special content for subscribers.

25th February 2026

TimothyEnfom

apparition penetrating assets door

Serenity Cox www.serenitycox.ing shares exclusive content and regular updates. Follow her on Instagram, Twitter, and Telegram to stay up-to-date on creative projects and inspiring events.

25th February 2026

ArthurSub

map happenstance aftermath

Dive into the world of Dolly Little dolly little original videos, exclusive photos, and unique content available on OnlyFans and other services. Regular updates and fresh publications for subscribers.

25th February 2026

Douglasanele

view happenstance rings

Jill Kassidy Exclusives jill kassidy featuring original content, media updates, and special announcements.

25th February 2026

MichaelGuept

contemplation happenstance assess

Scarlett Jones https://scarlettjones.in shares exclusive content and the latest updates. Follow her on Twitter to stay up-to-date with new publications and participate in exciting media events.

25th February 2026

MichaelGub

reverie chances door

?????? ?????? https://eva-vlg.ru ??????-????????? ? ??????? ??????? ??????, ?????????? ??? ? ?????? ??????. ?????? ??? ????? ???????, ?????, ??????? ? ??????? ??????? ?????????? ????? ???????? ?????????????.

25th February 2026

RobertCeala

blueprint big hesitation rings

Exclusive content Alexis Fawx http://www.alexisfawx.online/ original publications and special updates. Follow us on social media to stay up-to-date on new releases and participate in exciting events.

25th February 2026

DanielFah

plan fortune fuck obstruct

Google salaries by position https://salarydatahub.uk comparison of income, base salary, and benefits. Analysis of compensation packages and career paths at the tech company.

25th February 2026

WillisEvaxy

contemplation happenstance door

Exclusive Aeries Steele www.aeriessteele.online intimate content, and original publications all in one place. New materials, special announcements, and regular updates for those who appreciate a premium format.

25th February 2026

JamesCurdy

view fortune aftermath

Riley Reid www.rileyreid.ing is a space for exclusive content, featuring candid original material and regular updates. Get access to new publications and stay up-to-date on the hottest announcements.

25th February 2026

JamesTreli

guesstimate happenstance rings

Luiza Marcato Official luizamarcato online exclusive updates, personal publications, and the opportunity to connect. Get access to unique content and official announcements.

25th February 2026

DavidCrile

iniquity boastfully hesitation misshape

Shilpa Sethi www.shilpasethi.in official page features unique, intimate content and premium publications. Private updates, fresh photos, and personal announcements are available to subscribers.

25th February 2026

Richardthate

scheme happenstance rings

Unique content from Angela White https://angelawhite.ing new publications, exclusive materials, and personalized updates. Stay up-to-date with new posts and access exclusive content.

24th February 2026

Allenpen

mirage high-principled chance rings

Eva Elfie https://evaelfie.ing shares unique intimate content and new publications. Her official page features original materials, updates, and exclusive offers for subscribers.

24th February 2026

MartinBex

mirage serendipity aftermath

Sweetie Fox sweetiefox ing offers exclusive content, original publications, and regular updates. Get access to new materials, private photos, and special announcements on the official page.

24th February 2026

JamesFaind

vision pious outcome misshape

Lily Phillips https://www.lily-phillips.com offers unique intimate content, exclusive publications, and revealing updates for subscribers. Stay up-to-date with new content, access to original photos, and special announcements on her official page.

24th February 2026

Mauriceeneds

apparition pietistic holdings rift

Exclusivo de Candy Love https://www.candylove.es contenido original, publicaciones vibrantes. Suscribete para ser el primero en enterarte de las nuevas publicaciones y acceder a actualizaciones privadas.

24th February 2026

Davidhit

brown about fortuity rings

Shilpa Sethi shilpasethi in exclusive content, breaking news, and regular updates. Get access to new publications and stay up-to-date on the most interesting events.

24th February 2026

Darrylcroms

absent-mindedness happenstance aftermath

Free online games https://oyun-oyna.com.az with no installation required—play instantly in your browser. A wide selection of genres: arcade, racing, strategy, puzzle, and multiplayer games are available in one click.

24th February 2026

auto 711

apparition twist of fate rings

A catalog of cars https://auto.ae/catalog/ across all brands and generations—specs, engines, trim levels, and real market prices. Compare models and choose the best option.

24th February 2026

auto 111

wool-gathering happenstance curve

A catalog of cars http://www.auto.ae/catalog/ across all brands and generations—specs, engines, trim levels, and real market prices. Compare models and choose the best option.

23rd February 2026

casino games 73

meditation happenstance aftermath

?????? ???? ?????? - ??????? ????? ?????????, ??????? ?? ?????? ? ???????? ?? ???????. ??????, ??????? ?? ?????????? ??????????.

22nd February 2026

casino games 13

make a proposal to fat asunder door

?????? ???? ?????? ?????? - ??????? ????? ?????????, ??????? ?? ?????? ? ???????? ?? ???????. ??????, ??????? ?? ?????????? ??????????.

22nd February 2026

online casino 48

vision happenstance assess

????? ? ???????? ?????? ???? ?????? — ??????? ????? ????????? ?? ?????????? ????, ???????? ?????? ?? ?????????? ??????????. ?????????? ??? ????? ?????? ?? ????????? ?????.

22nd February 2026

casino bonus 26

meditation seemly wherewithal door

???????? ?????? ?????? — ????????? ?????, ???????????? ?????????? ?? ??????? ?? ???????. ?????? ?? ?????????? ???? ??????.

22nd February 2026

online casino 83

reverie quirk persuade

????? ? ???????? ???? ?????? ?????? — ??????? ????? ????????? ?? ?????????? ????, ???????? ?????? ?? ?????????? ??????????. ?????????? ??? ????? ?????? ?? ????????? ?????.

21st February 2026

casino bonus 35

idea good affluence rings

???????? ?????? ?? ??????????? — ????????? ?????, ???????????? ?????????? ?? ??????? ?? ???????. ?????? ?? ?????????? ???? ??????.

21st February 2026

RobertGed

map happenstance misshape

?????? ?????? ?????????: https://le-parfume.ru/parfyumeriya/zhenskaya-parfyumeriya/calvin-klein/

21st February 2026

Michaelhit

blueprint happenstance nobility

?????? ?????? ????? ??????? ??? ????????? ???????? ?? ??? ??????????, ?????????, ??????? ?????????? ????????? ? ???? ?????????. ??????? ?????? ? ?????????? ????????.

21st February 2026

Patricksig

apparition boastfully upon unconscious rapidly fuck compression

????????? ???????? ??? ???? ?? ??????? https://atlapool.ru

20th February 2026

seovestnik 90

figment of the fancy fortuity acclivity

?????? ??????? SEO https://seovestnik.ru ? IT-????????? — ?????????, ????????????, ???-??????????, ????????????????? ? ???????? ??????????? ??? ???????.

20th February 2026

seovestnik 49

brown library serendipity cheat

?????? ??????? SEO https://seovestnik.ru ? IT-????????? — ?????????, ????????????, ???-??????????, ????????????????? ? ???????? ??????????? ??? ???????.

20th February 2026

Danielhed

fantasy high-principled razing aftermath

Carbon credits https://offset8capital.com and natural capital – climate projects, ESG analytics and transparent emission compensation mechanisms with long-term impact.

20th February 2026

Danielhed

pipedream boastfully hesitation acclivity

Carbon credits https://offset8capital.com and natural capital – climate projects, ESG analytics and transparent emission compensation mechanisms with long-term impact.

20th February 2026

Paulo Davi Lucca

Pergunta: Existe Tratamento Para a Disfunção Erétil?

Quando o paciente possui Disfunção Erétil Primária (pessoa que sempre teve complexidade de começar ou conservar ereção) ou é alguém com idade avançada, podes ser inevitável a combinação entre a Psicoterapia e alguma medicação. Pela Psicoterapia é possível decidir uma rua de trocas honestas a respeito masculinidade, história de existência, traumas, relacionamentos e sentimentos, tópicos esses que os homens em geral estão insuficiente acostumados a enfrentar, comentar ou falar sobre este

18th February 2026

Paulo Davi Lucca

Pergunta: Existe Tratamento Para a Disfunção Erétil?

Quando o paciente possui Disfunção Erétil Primária (pessoa que sempre teve complexidade de começar ou conservar ereção) ou é alguém com idade avançada, podes ser inevitável a combinação entre a Psicoterapia e alguma medicação. Pela Psicoterapia é possível decidir uma rua de trocas honestas a respeito masculinidade, história de existência, traumas, relacionamentos e sentimentos, tópicos esses que os homens em geral estão insuficiente acostumados a enfrentar, comentar ou falar sobre e

18th February 2026

Maria Maria Clara

Ondas De Choque Para Disfunção Erétil: Saiba Mais Sobre isto Esse Tratamento

Os fatores comportamentais ou de hábitos de vida provocam tal o funcionamento rápido da ereção quanto os riscos de complicações orgânicas no futuro. Dessa maneira , a natureza multifatorial da disfunção erétil , incluindo os fatores orgânicos e psicológicos requer, para seu controle , uma equipe multidisciplinar , em tão alto grau para o diagnóstico como pro tratamento adequado. Com isto , advém os defeitos de relacionamento familiar, matrimonial , profissional , financeiro, social, e

18th February 2026

Maria Maria Clara

Ondas De Choque Para Disfunção Erétil: Saiba Mais Sobre isto Esse Tratamento

Os fatores comportamentais ou de hábitos de vida provocam tal o funcionamento rápido da ereção quanto os riscos de complicações orgânicas no futuro. Dessa maneira , a natureza multifatorial da disfunção erétil , incluindo os fatores orgânicos e psicológicos requer, para seu controle , uma equipe multidisciplinar , em tão alto grau para o diagnóstico como pro tratamento adequado. Com isto , advém os defeitos de relacionamento familiar, matrimonial , profissional , financeiro, social, e

18th February 2026

studiya dizayna interera 68

deception fluke column

?????? ????????? ???? ???????? ????????? ???

17th February 2026

cryptoboss casino ???????????

??????? ? ?????????? ??????: ???????????? ?????? ?? ??????????.

Hi there! I just wanted to ask if you ever have any problems with hackers? My last blog (wordpress) was hacked and I ended up losing many months of hard work due to no backup. Do you have any methods to protect against hackers? https://cryptobossmacher.top/

16th February 2026

Jacquie

????????? ???? ????

«??????????» — ??? ????????????? ????-????, ??? ?????? ?????? ?? ?????????? ????????????, ?????????? ? ??????? ???????? aviamaster 1win ???????. ???? ?????? — ??????? ??????? ??????, ?????? ??? ??????? «??????????».

16th February 2026

Ivey

Minedrop — ?????????? ??????-???? ? ????? Minecraft

Minedrop — ???? ??? ????????? ????????! ?????????? ??????? ? ????? Minecraft, ????? ? ?????????? ? ???????? ????? minecraft ??????. ??????-?????? ?????????? ?????? ?????????????? ?????? ? ???????. ?????????? ?????, ???????? ???????? ? ??????????? ?????????? ????????. ????? ? ?????? ?????!

16th February 2026

???? ?????????? ??????

??????????????? ?????????? ??????: ????????? ??????? ? ???? ??????.

Hello mates, pleasant post and fastidious urging commented at this place, I am in fact enjoying by these. https://cryptoboss353.top/

14th February 2026

Launa

Im happy I now registered

Feel free to visit my web site - Betify casino

13th February 2026

João Miguel

Disfunção Erétil: O Que é, Sintomas, Causas, Medicamentos E Mais

"Várias são as enfermidades conhecidas relacionadas à disfunção erétil: doença cardiovascular (hipertensão, aterosclerose), diabetes, depressão, alcoolismo, tabagismo, operação ou trauma pélvico/perineal, doença neurológica (acontecimento vascular cerebral, esclerose múltipla, doença de Parkinson, lesão da medula espinhal), obesidade, radiação pélvica ou até já doença de Peyronie (provoca encurtamento, aflição ou curvatura do pênis). Uso permanente corta a eficiência: Existe a crença de que util

13th February 2026

João Miguel

Disfunção Erétil: O Que é, Sintomas, Causas, Medicamentos E Mais

"Várias são as enfermidades conhecidas relacionadas à disfunção erétil: doença cardiovascular (hipertensão, aterosclerose), diabetes, depressão, alcoolismo, tabagismo, operação ou trauma pélvico/perineal, doença neurológica (acontecimento vascular cerebral, esclerose múltipla, doença de Parkinson, lesão da medula espinhal), obesidade, radiação pélvica ou até já doença de Peyronie (provoca encurtamento, aflição ou curvatura do pênis). Uso permanente corta a eficiência: Existe a crença de que util

13th February 2026

ejaculaçao precoce faz filho

Disfunção Erétil (Impotência)

Exercício físico regular: a atividade física regular poderá acudir a aperfeiçoar a saúde cardiovascular, aumentar os níveis de energia e suprimir o estresse, o que poderá favorecer a função erétil. Câncer de próstata: o câncer de próstata é uma das formas mais comuns de câncer entre os homens e pode afetar adversamente a atividade erétil, de forma especial quando os tratamentos envolvem operação, radioterapia ou terapia hormonal. A radioterapia assim como poderá causar danos aos nervos e v

11th February 2026

ejaculaçao precoce faz filho

Disfunção Erétil (Impotência)

Exercício físico regular: a atividade física regular poderá acudir a aperfeiçoar a saúde cardiovascular, aumentar os níveis de energia e suprimir o estresse, o que poderá favorecer a função erétil. Câncer de próstata: o câncer de próstata é uma das formas mais comuns de câncer entre os homens e pode afetar adversamente a atividade erétil, de forma especial quando os tratamentos envolvem operação, radioterapia ou terapia hormonal. A radioterapia assim como poderá causar danos aos nervos e

11th February 2026

Maria Rebeca

O Que é Disfunção Erétil?

Nos últimos anos, contudo, extensa abundância de estudos provocou uma revolução nesta área, oportunizando melhor discernimento da fisiologia peniana e, consequentemente, a descoberta de novos métodos cirúrgicos e farmacológicos para o tratamento da impotência. A extensa diversidade de estudos provocou a descoberta de novos métodos cirúrgicos e farmacológicos para o tratamento da impotência sexual. José Mário Reis - Não irei reiterar que o cigarro razão impotência sexual, visto que isso es

11th February 2026

Maria Rebeca

O Que é Disfunção Erétil?

Nos últimos anos, contudo, extensa abundância de estudos provocou uma revolução nesta área, oportunizando melhor discernimento da fisiologia peniana e, consequentemente, a descoberta de novos métodos cirúrgicos e farmacológicos para o tratamento da impotência. A extensa diversidade de estudos provocou a descoberta de novos métodos cirúrgicos e farmacológicos para o tratamento da impotência sexual. José Mário Reis - Não irei reiterar que o cigarro razão impotência sexual, visto que isso

11th February 2026

https://www.almanacar.com/profile/MickiRve06

Just want to say Hi!

Super article ! Contenu pertinent. Continuez comme ça ! https://www.almanacar.com/profile/MickiRve06

11th February 2026

MoneyJournals

MoneyJournals

Well written and easy to understand. I’ll keep this in mind going forward. MoneyJournals

10th February 2026

ejaculaçao precoce hipnose

Pergunta: Existe Tratamento Para a Disfunção Erétil?

Solução definitiva para quadros graves e refratários. A perda de libido poderá ser um sintoma isolado, no entanto também poderá ver de perto quadros de impotência sexual, aumentando ainda mais o embate emocional e físico. Sim. Além de impactar a vida sexual, a DE poderá ser um sinal de alerta para dificuldades de saúde mais graves, como doenças cardiovasculares. Uma das maiores problemas é aceitar que a DE não é só um defeito sexual, mas sim um sinal de alerta pra saúde geral. Neste

10th February 2026

ejaculaçao precoce hipnose

Pergunta: Existe Tratamento Para a Disfunção Erétil?

Solução definitiva para quadros graves e refratários. A perda de libido poderá ser um sintoma isolado, no entanto também poderá ver de perto quadros de impotência sexual, aumentando ainda mais o embate emocional e físico. Sim. Além de impactar a vida sexual, a DE poderá ser um sinal de alerta para dificuldades de saúde mais graves, como doenças cardiovasculares. Uma das maiores problemas é aceitar que a DE não é só um defeito sexual, mas sim um sinal de alerta pra saúde geral. Neste g

10th February 2026

ejaculaçao precoce oq fazer

Disfunção Erétil: Causas, Diagnóstico E Tratamentos Eficazes

Quando você está sob estresse ou enfrentando dificuldades de saúde mental, ele poderá ter problema em libertar os hormônios necessários pra dar início uma ereção. A disfunção erétil (DE) é uma complexidade para atingir ou manter uma ereção suficiente pra um funcionamento sexual esmagador. Por outro lado, condições como inflamação crônica da próstata (prostatite) ou câncer de próstata são capazes de transportar a sintomas como ejaculação dolorosa e contrariedade pra atingir ou preservar

9th February 2026

ejaculaçao precoce oq fazer

Disfunção Erétil: Causas, Diagnóstico E Tratamentos Eficazes

Quando você está sob estresse ou enfrentando dificuldades de saúde mental, ele poderá ter problema em libertar os hormônios necessários pra dar início uma ereção. A disfunção erétil (DE) é uma complexidade para atingir ou manter uma ereção suficiente pra um funcionamento sexual esmagador. Por outro lado, condições como inflamação crônica da próstata (prostatite) ou câncer de próstata são capazes de transportar a sintomas como ejaculação dolorosa e contrariedade pra atingir ou preservar

9th February 2026

vibs.me

Primeiro Gel Pra Disfunção Erétil é Aprovado; Artefato Promete Ereções Firmes E Riscos Reduzidos

Gerenciamento de estresse: Práticas como meditação, ioga, pilates e outras técnicas de relaxamento conseguem apagar os níveis de cortisol no corpo e apagar a tensão psicológica, o que impacta positivamente pela cautela da disfunção erétil de origem emocional. Ansiedade e temor de falhar: O susto de não conseguir ter ou preservar a ereção poderá gerar um estágio de tensão que intensifica ainda mais o problema. Problemas psicológicos: Ansiedade de desempenho, estresse e insegurança c

9th February 2026

vibs.me

Primeiro Gel Pra Disfunção Erétil é Aprovado; Artefato Promete Ereções Firmes E Riscos Reduzidos

Gerenciamento de estresse: Práticas como meditação, ioga, pilates e outras técnicas de relaxamento conseguem apagar os níveis de cortisol no corpo e apagar a tensão psicológica, o que impacta positivamente pela cautela da disfunção erétil de origem emocional. Ansiedade e temor de falhar: O susto de não conseguir ter ou preservar a ereção poderá gerar um estágio de tensão que intensifica ainda mais o problema. Problemas psicológicos: Ansiedade de desempenho, estresse e insegurança conse

9th February 2026

Dominique

I am the new one

Casinolevant blog ve güncel adresine ula?abilirsiniz: levant casino

9th February 2026

Twisted Love Spicy Lines Pdf

Twisted Love Epub Vk

The emotional landscape of this book is vast, covering everything from grief and trauma to joy and passion. Alex and Ava are a couple that you want to succeed, despite the odds stacked against them. If you prefer digital formats, the Twisted Love PDF is the perfect way to read. The book handles sensitive topics with care, never using them just for shock value. It is a deeply romantic story that believes in the healing power of love, even for the most damaged souls.

4th February 2026

twistedlovepdfded

Twisted Love Anna Huang Epub

The journey of Alex Volkov from a man of ice to a man of fire is one of the best character arcs in recent romance. Ava is the catalyst for this change. A download of the Twisted Love PDF lets you witness this transformation. The book shows that even the most damaged people are capable of great love. It is a hopeful, inspiring, and incredibly sexy read. https://twistedlovepdf.site/ Twisted Love Pdf Book

3rd February 2026

Trudi

??????? ???????????

??????????? ?????????? ??? ? ?????? ???????????? ??????????? ??????? ? ??????????? ???????? ?????? ??????. ????????? ????????? ?????????, ?? ????????? ???????? ?????, ?????????? ?? ?????????? ????????????.

3rd February 2026

Brandie

????????? ???? ????

«???????» — ??? ????????????? ????-????, ??? ?????? ?????? ?? ?????????? ????????????, ?????????? ? ??????? ???????? aviamasters ?????? ?????????. ???? ?????? — ??????? ??????? ??????, ?????? ??? ??????? «??????????».

31st January 2026

Alexandria

Just want to say Hi!

Huge thanks for such valuable content. Will definitely recommend Big Bass Splash to friends. Big Bass Splash official site

29th January 2026

Norris

????????? ???? ????

«???????» — ??? ????????????? ????-????, ??? ?????? ?????? ?? ?????????? ????????????, ?????????? ? ??????? ???????? aviamasters-official.online. ???? ?????? — ??????? ??????? ??????, ?????? ??? ??????? «??????????».

25th January 2026

Maria Rebeca

Tratamento Pra Disfunção Erétil: Quando é Preciso?

Portanto, não deixe de procurar auxílio com urologistas ou sexólogos com experiência no tratamento de disfunções sexuais. Urologistas e sexólogos são profissionais capacitados pra suportar com uma série de disfunções sexuais. A principal semelhança entre esses profissionais é que ambos lidam com dúvidas relacionadas à saúde sexual, como as disfunções sexuais. Antitestosterona (como Avodart): Esses remédios bloqueiam a ação da testosterona, impedindo o progresso da próstata. Tendo com

25th January 2026

Maria Rebeca

Tratamento Pra Disfunção Erétil: Quando é Preciso?

Portanto, não deixe de procurar auxílio com urologistas ou sexólogos com experiência no tratamento de disfunções sexuais. Urologistas e sexólogos são profissionais capacitados pra suportar com uma série de disfunções sexuais. A principal semelhança entre esses profissionais é que ambos lidam com dúvidas relacionadas à saúde sexual, como as disfunções sexuais. Antitestosterona (como Avodart): Esses remédios bloqueiam a ação da testosterona, impedindo o progresso da próstata. Tendo co

25th January 2026

ejaculaçao precoce mercado livre

Conheça As Principais Causas Da Disfunção Erétil

Eroxon é um gel clinicamente comprovado para homens maiores de dezoito anos com disfunção erétil, que atua por intermédio de um efeito de resfriamento e aquecimento para incentivar o curso sanguíneo no pênis, facilitando a ereção. Eroxon é um gel muito bom e clinicamente comprovado, projetado particularmente para homens adultos que experimentam disfunção erétil, bem como conhecida como impotência. Quando se trata de solucionar a disfunção erétil, diversos pensam muito rapidamente em remé

24th January 2026

ejaculaçao precoce mercado livre

Conheça As Principais Causas Da Disfunção Erétil

Eroxon é um gel clinicamente comprovado para homens maiores de dezoito anos com disfunção erétil, que atua por intermédio de um efeito de resfriamento e aquecimento para incentivar o curso sanguíneo no pênis, facilitando a ereção. Eroxon é um gel muito bom e clinicamente comprovado, projetado particularmente para homens adultos que experimentam disfunção erétil, bem como conhecida como impotência. Quando se trata de solucionar a disfunção erétil, diversos pensam muito rapidamente em remé

24th January 2026

boyarka

Im glad I now registered

Wow, marvelous blog format! How lengthy have you ever beenn blogging for? you made running a blog glance easy. The entire look of your website is excellent, as neatly aas the content! http://boyarka-inform.com/

22nd January 2026

boyarka

I am the new one

Asking questions arre in fact pleasant thing if youu are not understanding something entirely, but this article gives pleasant understanding yet. http://boyarka-inform.com/

21st January 2026

hipotireoidismo disfunção eretil

Disfunção Erétil (Impotência)

Diversas podem ser as causas da ausência de ereção, tal fisiológicas, quanto psicológicas. Ansiedade, depressão e estresse conseguem afetar a ereção, visto que interferem diretamente na libido. Não atingir preservar uma relação sexual satisfatória com a parceira é pretexto de frustração e até mesmo depressão. Um possível fundamento é o aumento de radicais livres (espécies reativas de oxigênio) provocadas na inflamação das gengivas que poderia restringir a biodisponibilidade de ácido nítr

21st January 2026

isthisacryforhelppded

Is This A Cry For Help Paperback Vs Pdf

Grab the Is This a Cry for Help PDF and read the story today. This digital download is easy. Download the novel now and start. https://isthisacryforhelppdf.site/ Is This A Cry For Help Mega.nz

26th December 2025

bornoftroublepdfded

Top Rated Ebooks Pdf

Born of Trouble is a story that will challenge your beliefs and make you rethink your perspective. This thought-provoking and powerful narrative is now available in a digital pdf format. Engage with the big ideas and the difficult questions it raises. https://bornoftroublepdf.site/ Fantasy Novels Free Download

25th December 2025

TMTCash

https://tmtcash.org/

This was an enjoyable and informative read. I appreciate the clarity and effort put into making the content valuable. TMTCash

17th December 2025

Gerald Kent

https://tmt.cash/

Really valuable content here, well-organized and engaging! TMT Play

9th December 2025

MetabolicFreedomded

Learn how hormones, sleep, and food choices impact your metabolism and how to optimize them all.

Reset your metabolism without extreme fasting, endless cardio, or confusing meal plans - just clarity. https://metabolicfreedom.top/ metabolic freedom with ben azadi

25th November 2025

GratiaVitaeded

??????????? ??????? ????? — ????????? ?????????????????? ?????.

??????? ??????? ? ???????? ???? ?????? ???? — ???? ?? ??????. https://gratiavitae.ru/

21st November 2025

approved canadian pharmacies online

non prescription canadian pharmacy

legitimate online pharmacy https://directcanadianpharmacy.com/ [url=https://directcanadianpharmacy.com/]best online pharmacy no prescription[/url]

12th November 2025

canada online pharmacy

list of reputable canadian pharmacies

best internet pharmacies https://canadianpharmacyleaf.com/ [url=https://canadianpharmacyleaf.com/]good online mexican pharmacy[/url]

9th November 2025

compare pharmacy prices

canadian drugs

best online pharmacy stores https://canadianpharmacyleaf.com/ [url=https://canadianpharmacyleaf.com/]drug canada[/url]

8th November 2025

casinoua

?????? ??????

?????? ? ??????????? ??????????? ???????? ???????? ??? ???. ?????????? ?????? ?????? ?????????? ???????? ??? ????????. ?????????? ?????? ?????? ??????? ???????????? ???? ??????????. ?????? ? ???? ?? Apple/Google Pay? ????????? ?????????? ? ??????? — [url=https://casino-ua-online.biz.ua/]???????? ?????? ?????? ? ???????[/url]. ????? ?????? ??????? ????? ????????? ??????? ???????. ???????? ?????? ??????? ???????????? ??????? ????? ???????. ?????? ?????? ??????? ???????? ????? ? ????-???? ??? ?

4th November 2025

casinoua

?????? ??????

?????? ? ????????? ????? ???????? ???????? ?? ????????? ???????. ???????? ?????? ??????? — ?? ??????? ? ??????. ???????? ?????? ?????? ?????????? ????????? 24/7. ?????? ? ?????????? ? ?????? ??????? ????????? ???????????? ??????? ?????????? [url=https://casino-ua-online.biz.ua/]???????? ?????? ?????? ? ???????[/url]. ?????????? ?????? ?????? — ???????? ????????? ???. ?????????? ?????? ?????? ????? ??????? ???????? ???????. ?????? ?????? ??????? ?????????? ?????????? ????? ????. ?????????? ??

4th November 2025

casinoua

??????? ???????? ?????? ???????

??? ?????? ?????? ??????? — ??????? ?????? ????????? ?? ???????. ?????? ?????? ??????? ??????????? ?????? ?? ?????? ????. ????? ?????? ?????? ??????? ????? ???????? ?????. ??? ???????? ??????? ??????? ??????? ?????????: [url=https://casino-ua-online.biz.ua/]casino ua online biz ua[/url]. ?????? ??????? — ?? ???????? ????? ??? ????????? ??????????. ?????? ? ??????????? ??????????? ??? ????????? ?????????. ???????? ?????? ?????? ??????? ????? ?????? ?? ???????. ?????? ?????? ??????? ???????? ?

4th November 2025

casinoua

??? ?????? ?????? ???????

??????? ?????? ?????? ??????? ????????? ?????? ?????????? ?????????. ???????? ?????? ???????? ???????? ???? ? ??????????? ??????. ?????????? ?????? ???????? ???????????? ?????? ?????????. ?????? ???????? ???????? ??? «?????????» ???????????? ??????? ??? — [url=https://casino-ua-online.biz.ua/]???????? ?????? ????????[/url]. ?????????? ?????? ???????? ???????? ??? ????? ????????????. ?????? ? ??????????? ??????????? ??? ????????? ?????????. ???????? ?????? ?????? ??????? ????? ?????? ?? ?????

4th November 2025

pinko

pinco casino oyna

Pinco casino app download etm?kl? ist?nil?n yerd? ?yl?nc? sizinl?dir. Pinco casino giris sür?tli v? etibarl?d?r. Pinco azerbaijan tg kanal?nda yenilikl?r payla??l?r.

pinco ?????????

pinco.com

29th October 2025

pinko

pinco tg

Pinco az platformas?nda h?r gün yeni imkanlar aç?l?r. Pinco kazino t?hlük?sizlik bax?m?ndan yüks?k s?viyy?d?dir. Pinco kazino istifad?çi dostu interfeys? malikdir.

pinco-az-casino ing

pinco ????????

pinco casino uz

??????? pinco ?? ???????

29th October 2025

one sports

one sports

Simply unadulterated eminence from you here. I have never expected something not as much as this from one sports you and you have not puzzled me by any stretch out of the inventive vitality. I acknowledge you will keep the quality work going on.

28th October 2025

lewandowski

??????????? ???

?????? ?????????????? ????????? ???????? ????. ?????????????? ?????? ???? ??-?????? ???????? ?????? ???????. ??????????? ????? ??? ?????????? ???????, ????????? ???????? ???. ?????????????? ??????? ?????? ?????????? ????????. ?????? ??????? ???? ?????????? [url=https://robert-lewandowski-kg.com/]https://robert-lewandowski-kg.com/ ????????. ??????????? ??????????? ?????? ??????????? ??????????. ??????????? ???????? ????????? ???????? ?? ????? ?????????. ?????? ??????????? ?? ????? ?????

25th October 2025

lewandowski

???? ???????????

?????? ??????????? ???????? ?????????? ?? ????? ??????? ?????. ?????? ??????????? ??????? ????? ??????? ???????. ?????????????? ???????????? ?????? ?????????? ??????. ?????? ??????????? ???????? ?????? ???????. ???? ??? ?????????????? ?????? ??????? ???? ???????????? ???????? ???????? ?????, ???? [url=robert-lewandowski-kg.com]?????? ??????????? ??????? ???????. ????????????? ?????????????? ????? ??????????? ????????. ?????? ??????????? ?????????? ??????? ?????????. ?????????????? ????

25th October 2025

lewandowski

?????? ? ???????????

?????? ??????????? ?????? ?????????? ????? ??? ????????. ?????? ??????????? ??????? ????? ??????? ???????. ?????????????? ???????????? ?????? ?????????? ??????. ??????????? ????????? ?? ????? ?????????? ?????? ?????????. ???? ????? ??????????? ???????? ????????? ???????? ????? ?????, ???? [url=https://robert-lewandowski-kg.com/]?????? ??????????? ???????[/url] ??? ???????. ?????? ??????????? ??????????? ????? ????? ???????. ??????????? ???????? ????????? ???????? ?? ????? ?????????. ?????? ?

25th October 2025

pincoua

ppinko

Kuponda multi-bet, sistem v? tez düz?li? funksiyalar? var, s?hv ?msal da avtomatik düz?lir. Promokod bölm?sin? daxil olmaq asand?r, aktiv kodlar avtomatik tan?n?r. Android istifad?çil?ri [url=https://pinco-casino-azerbaijan.biz.ua/]pinco yükl?[/url] b?l?dçisini izl?y?r?k apk-ni bir d?qiq?y? qura?d?ra bil?r. Sür?tli öd?ni? üçün sevimli metodlar? saxlay?b bir klikl? istifad? etm?k olur. Minimum v? maksimum m?rc diapazonlar? h?m yeni ba?layanlar, h?m d? high-rollerl?r üçün uy?undur. Futbol üçün

23rd October 2025

pincoua

pinco casino kazakhstan

Matç önc?si statistik blokda komanda formas?, H2H v? z?d?lil?r siyah?s? toplan?b. Qeydiyyat e-mail v? ya telefonla 1 d?qiq?d?n az ç?kir, t?sdiqd?n sonra ba?lan??c bonusu aktivl??ir. R?smi domeni yadda saxlay?n: [url=https://pinco-casino-azerbaijan.biz.ua/]pinco-casino-azerbaijan biz ua[/url]; pinco azerbaycan yükle t?limat? bu ünvandad?r. Hesab t?hlük?sizliyi üçün iki faktorlu giri? v? cihazlar?n siyah?s? var. Canl? kazino bölm?sind? blackjack, rulet v? bakara masalar? 24/7 aç?qd?r. Yeni oyu

23rd October 2025

pincoua

pinco yukle

Canl? izl?m? v? canl? m?rc ekranlar? yan-yana aç?l?r, gecikm? minimumdur. Turnirl?rd? liderl?r c?dv?li ??ffafd?r, mükafatlar v? qaydalar ?vv?lc?d?n aç?qlan?r. Az?rbaycan bazar? üçün lokal t?klifl?r [url=https://pinco-casino-azerbaijan.biz.ua/]pinco-casino-azerbaijan.biz.ua[/url] s?hif?sind? toplan?b — limitl?r AZN üzr? göst?rilir. Hesab t?hlük?sizliyi üçün iki faktorlu giri? v? cihazlar?n siyah?s? var. Sür?tli oyunlar v? crash-mekanikalar q?sa sessiyalar üçün ideal h?ll t?qdim edir. Hesab id

23rd October 2025

pincoua

pinco.win

M?suliyy?tli oyun al?tl?ri — limitl?r, pauza v? self-exclusion — profil ayarlar?nda ?lçatand?r. VIP proqramda s?viyy? artd?qca ke?bek faizi v? ç?xar?? prioriteti yüks?lir. Canl? futbol statistikalar?n? izl?y?rk?n [url=https://pinco-casino-azerbaijan.biz.ua/]pinco-casino-azerbaijan.biz.ua[/url] p?nc?r?sini aç?q saxlay?n — pinco bonus elanlar? tez-tez yenil?nir. Mübahis?li hallarda d?st?k operatoru dialoq tarixç?sini v? kupon ID-ni t?l?b edir — proses ??ffafd?r. Top oyunlar v? yeni relizl?r ayr?

23rd October 2025

neymar

?????? ??????????

?????? ?? ?????? ????? ???????: ?????, ????????, training — ??? ????? ??? ?????? ?????????? ??? ??????? ??????? apk, ????? ???????? ????? ? ????? ??????? ????? ?? ????? canl? izl?m?? ????? ??????????? ???????? ??? ?????? ??????? — ?????? ????? ? ????. [url=www.neymar-kg.com]www.neymar-kg.com[/url]. ??? ????? «?????? ???? ???» ? ????-??? ? ???????????, ????? ??????? ????? ????????? ??? «?????? ????????? ????» ? ????????????? ???????????? ? ???????? ? ?????. ??? ?????? ?????? ?????? — ???????? ?

18th October 2025

neymar

?????? ???? ????????

?????? ? «?????????» ? ???: ??? ??? ??? ????????? ? ????????, ?? ?????? ? ??????????? ???????? ????????? ??????? 2011 ? 2017: ????, ???????, ????? — ???????? ???? ??? ???????????? ???????. ????? ??????????? ???????? ??? ?????? ??????? — ?????? ????? ? ????. [url=www.neymar-kg.com]www.neymar-kg.com[/url]. ????? «???? ?????? 4?» ??? ?????????? ? ? ?????????? ?????? ??? ?????? ??????. ??? ?????? ?????? ?????? — ?????????? ???????? ???????? ? ???????????? ??? ? ??????. ????? «???? ?? ??????? ?????

18th October 2025

neymar

?????? ???? ?? ???

??? ???????? ???? 4K ? ????????: ?????, ??? ??? ?????? «??????» — ??? ??????????? ??? ????????? ??? ?????????? ???????????? «?????? ????» ? ????????? ????????? ??? ?????? ? ??????? ??????? ????????? ?????: ????????, ???????, ??????? ?? ????????? ????? ????. [url=www.neymar-kg.com]www.neymar-kg.com[/url]. ?????? ?????????: ?????? ??????? ?????? ??????, ???-??-?? ????? ? ???????? ? ?????. ?????? ??????? ???????: ?????? ?????? ????/???????/?????? ? ????? ?????. ??? ?????? ?????? ?????? — ????????

18th October 2025

neymar

????? ??????? ?????? ??????

??? ?????? ?????? ?????? ? ??? ????? ???????? ????? ??????? ?????? ??? ????? ??????? mobil futbol. ????????? ??????? 2011 ? 2017: ????, ???????, ????? — ???????? ???? ??? ???????????? ???????. ????? «?????? ???? 4?» ??? ??????? ?????? ? ? ?????????? ???????????? ??????. [url=https://neymar-kg.com/]?????? ???? 4?[/url]. ?????? ?????? ? ????????????: ??????????? ???-3 ??? ????????. ?????? ???????: ??? ????????? ??? ??????? — ???????, ????????, ???? ? ??????????. ?????? ?????????? ?????: ????????

18th October 2025

islammakhachev

????? ??????? ???????????

UFC???? ????????, ??????? ???? ???????????? ??? ????? ??????????, ??????? ??????????. UFC 311 ???????? ???? ??????, ????? ?????????? ???????????? ??????? ???????? ??????????. [url=https://www.islam-makhachev-kg.com/]www.islam-makhachev-kg.com[/url] ????, ????? ???? ????????? ????? ????? ??????? ????? ???????. ?????? ??????????? ???????????. UFC???? ??????? ???????????, ?????????? ???? ????? ???????? ?????? ?????????? ??????? ???. ???? ????? ????? ?????, ???? ???? ??????? ????? ?????????. ?????

16th October 2025

islammakhachev

????? ??????? ?????? ????

??????????? ???? ???????? ?????????: ?????? ???????, ??????? ??????, ?????????????? ???? ??????????. ??????? ??????? ??????? ???????? ????, ?????? ???? ??????????? ???????. [url=https://islam-makhachev-kg.com/]islam-makhachev-kg.com[/url] ?????? ??????????, ?????? ???? ?????????? ??? ????? ?????????. ??????????? ?????? ????????. ????? ??????? vs ????? ??????? ???????? ??????????? ??????? ??? ???? ??? ??????? ??????????. ????????? ????????????: ???????, «????????», ?????? ???? ?????? ???????? ?

16th October 2025

islammakhachev

????? ??????? ? ?????????

?????????, ??????????? ???? ??????? ?????? ??????????? ?????? ????? ?????????? ??????? ??????. ??????? ??????? ??????? ???????? ????, ?????? ???? ??????????? ???????. [url=https://islam-makhachev-kg.com/]????? ??????? ???????????[/url] ??????? ????? ???? ????? ??????? ?????????? ?????????? ?????? ????? ????? ???. ?????????? ????????. ??????????? ?????????????? ??????????? ????????, ????????? ???? ??????? ??????? ??????????. ????? ???? ???????? ???????????? ?????? ???????? ???? ??????? ????????

16th October 2025

islammakhachev

????????? ????? ???????

????? ??????? ??? ????? ???? ????? ?????????? ???????? ?????, ??? ?????? ???????? ????????? ???? ?????? ????????????? ???????????. ????????? ??-???? ???? ???? ????? ?????? ?? ?????? ????????????? ???????. [url=https://islam-makhachev-kg.com/]www.islam-makhachev-kg.com[/url] ??????????????? ???????? ???????? ???? ??? ????. ?????? ???????? ??????? ????? ?????????? ?????. ??????? ?????????? ??????? ??????????? ???? ?????, ?????? ???? ?????????? ???????? ???????. ????? ???? ???????? ???????????? ?

16th October 2025

harrykane

????????? ????? ????

????? ???? ?????? ????????? ?? ????? ??????????????? ????.??????? ?????? ???? ???????????? ??????. ????? ??????? ????????? ???? ?????????? ???????? ?????? ???????? ???? ?????: [url=https://harry-kane-kg.com/]????? ???? ?????? ?????[/url]. ???? ?????? ????? ??????????? ???? ???????????. ????????? ???? ???? ??????????? ??????. ????? ???? ???? ???????? ???? ??????????. ??? ?????????? ?? ?????? ?????????? ??. ??????? ????????? ??????? ?????. ??????? ???????? ?????? ??????? ??? ??????? ?????????.

15th October 2025

floydmayweather

Floyd Mayweather

????? ???????? ????????? ?? ???????? ???????????? ????. ????? ???????? ???????????? ???? ?????? ?????? ??????. ???? ???????????? ?? ??? ?????????? ???? ???????? ????? ???????? – [url=https://floyd-mayweather-kg.com/]????? ???????? ??????????[/url]. ????? ???????? ??? ??????? ????? ???? ????? ??????????. ????? ???????? – ????? ???????????? ????. ????? ???????? ?? ????? ???????? ??????? ?????? ???????. ???? ?? ??? ?????????? ????? ??????????. ???? ?????? ??????? ??? ???? ??????. ????? ??????

12th October 2025

floydmayweather

Floyd Mayweather

????? ??????????? ?? ??? ??????? ??? ??? ?????? ????? ??????. ????? ??????????? ?????? ??????????? ?? ??? ?????????? ??????????. ???? ???????????? ???? ???????? ???????? [url=https://floyd-mayweather-kg.com/]https://floyd-mayweather-kg.com/[/url] ?????????? ?????????. ????? ?????????? ????? ?? ??? ????? ????????? ???? ??????. ???? ????????? ?? ????? ????? ????? ?????????. ???? ?????? ???????????? ????? ?????? ???? ???. ????? ???????? – ????????????????????? ???????. ????? ???????? ????????

12th October 2025

floydmayweather

Floyd Mayweather

????? ??????????? ??????? ???? ???????? ???????? ????. ????? ??????????? ?????? ??????????? ?? ??? ?????????? ??????????. ????? ???????? ???????? ?????? ??????????? [url=https://floyd-mayweather-kg.com/]????? ???????? ?????? ??????????[/url] ?????????? ???????????. ???? ????????? ???????? ??????? ????????. ????? ???????? ?? ??? ???????? ????? ????????? ????????. ????? ??????????? ????????? ??? ?????? ???????? ?????????. ????? ??????????? ??????? ?? ??????????. ????? ??????????? ??????? ???

12th October 2025

floydmayweather

Floyd Mayweather

????? ??????????? ????? ???? ????? ??????? ????? ??????. ????? ??????????? ????????? ???? ?? ????? ????????. ?????? ????????? ???? ???????????? [url=https://floyd-mayweather-kg.com/]????? ???????? ????????[/url] ????????? ??????. ????? ??????????? ???????? ???????? ???? ????. ???? ???????? ?? ??? ????????? ?????????. ?? ???? ????????? ?? ????? ?????? ??????. ?? ???????? ??????? ????? ?????? ?? ????????. ???? ???????? ??????????? ?????????. ???? ????????? ???????? ?????? ???????? ???. ?????

12th October 2025

alexpereira

????? ??????? ?????? ?????

????? ?????????? ???? ????? ????????? ????? ??????????. ????? ?????? ?????? ????????, ????????? ???? ???? ????. ????? ??????? ???????? ?? ?????? ???????????? ???? ?????? ?????? ????? — [url=https://alex-pereira-kg.com/]????? ???????[/url]. ??? ??????? “??????” ??? ????? ???????. ???? ????????? ???? ????????? ????? ?????????. ??????? ???????? ???????? ????? ????????. ??????? ?? ??? ?????? ????? ????? ?????. ???? ?????????? ????? ?????? ????? ????? ??????. ????? ?? ???????? ???????, ????? ??

10th October 2025

alexpereira

??? ????? ???????

?????? ????????? ??????? ???? ????? ?????????? ????? ??????. ?????, ????? ??????? ??????? ??????, ??? ????? ???????? ?????????. ????? ????????, ????????? ???? ????????? ???? ??????: [url=https://alex-pereira-kg.com/]alex-pereira-kg.com[/url]. ???? ?????? ??????? ????????, UFC ??????????? ????? ?????. ?? ????? ??? ?????????, ????? ?? ????? ?????????. ??????? ?????? ???? ????????? ?????. ???? ?????????? ?????????? ?? ???????. ????? ?????, ??????? ????? ??????? ?????. ??????? — ????? ????????

10th October 2025

alexpereira

????? ??????? ?????? ? ???

??????? ?????????? ???? ????? ??????? ?????? ????, ??????? ??????? ??? ????????. ?????, ????? ??????? ??????? ??????, ??? ????? ???????? ?????????. ?? ????????? ????? ???????? UFC ???????? — [url=https://alex-pereira-kg.com/]????? ??????? ?????????[/url]. ??? ??????? “??????” ??? ????? ???????. ????? ??????? — UFC???? ?? ????? ????? ?????? ???????????? ????. ????? ??????? UFC?? ????? ????? ?????. UFC ????????? ?????? ??????? ?????? ?????. ??? ????? ?????? “monster”. ????? ?? ???????? ?????

10th October 2025

alexpereira

????? ??????? ??????

????? ??????? ?????? ??? ?????? ?????? ????, UFC???? ?????? ??????? ????? ?????. ?????????? ??????? ???, ?? ??? ?????? — ???? ???. ??? ????? ???? ?????? ???????????? ???????: [url=https://alex-pereira-kg.com/]https://alex-pereira-kg.com[/url]. ??????? ????? ???? ???????? ??????? ?????? ?????. ????? ??????? — UFC???? ?? ????? ????? ?????? ???????????? ????. ??????, ????? ??????? ??????? ????? ????? ????. ??????? ?? ??? ?????? ????? ????? ?????. ??????? ?????? ????????? ?????-????? ???????? ??

10th October 2025

lukamodric

???? ?????? ??????? ?????

???????? ?????? ????? ?????? ????????, ?????? ??????.???? ?????? ?????? ?? ????? ????? ??????? ????? ???????. ???? ?????? ????? ??? ??????????? ?????????? ?????? “??????? ??? ???? ?????????” ??? ??????? — ????? ?? ???? ??? ???????? ????. ?????/???????? ???????? ????????? ????? — ????????? ??????: [url=https://luka-modric-kg.com/]???? ?????? ????????[/url]. ???? ?????? ?? 2022?? ???? ????? ??? ????????. ???? ?????? — ??????? ????-?? ???????. ???? ?????? ???????? ????? ??????? ??????. ??? ???

8th October 2025

lukamodric

???? ?????? ???????? ???????

???? ????????? ?????????? ?? ?????????? ?????.?????? ????? ????, ???? izi ???????? ?????. ???????? ?????? ???????? ?????????? ?? ????????. ?????? “??????? ??? ???? ?????????” ??? ??????? — ????? ?? ???? ??? ???????? ????. ?????? ???????? ?????????? ???????? ???: [url=https://luka-modric-kg.com/]???? ?????? ??????????[/url]. ???? ?????? ?? 2022?? ???? ????? ??? ????????. ???? ?????? — ??????? ????-?? ???????. ??? ???? ??????? ??? ?????? ???????. ???? ????? ???????????????? ???? ??????. ??? ?

8th October 2025

lukamodric

??? ?????? ???? ??????

?????? ??????? ???????? ??? ???????? ????? ?????.???????? ??????????? ????????? ???????? ??????? ?????. ???????? ?????? ???????? ?????????? ?? ????????. ????????? ????????? ??? ????????. ?????????? ?????? ?????????? ??? ???????? — ???????? ????? ??????: [url=https://luka-modric-kg.com/]???? ?????? ??????[/url]. ???? ?????? ?? 2022?? ???? ????? ??? ????????. ?????? ????? ????? — ?? ????? ?????????? ????. ??? ??????? ??????? — ?????? ?????. ?????? ?????????? ????? ??????? ???????? ??. ???? ??

8th October 2025

laligaaz

?™n ?§ox laliga qazanan komanda

H?r turun n?tic?l?ri real vaxtda yenil?nir. Yeni mövsüm üçün LaLiga s?ralamas? art?q d?rc olunub. Bu h?ft? LaLiga canl? oyunlar? çox maraql?d?r. Loqodak? d?yi?iklikl?r brendin müasir ruhunu ?ks etdirir. Futbol azarke?l?ri üçün etibarl? m?nb? — [url=https://laliga.com.az/]LaLiga standings[/url]. Komandalar?n xal durumu v? n?tic?l?ri h?r gün t?z?l?nir. ?n çox qol vuran LaLiga futbolçular? kiml?rdir?. LaLiga tv canl? baxmaq üçün seçiml?r. LaLiga defenders v? midfielders siyah?s?. ?n ço

5th October 2025

laligaaz

laliga ma?§lar

?spaniya çempionat?n?n ?n maraql? matçlar?n? buradan izl?yin. LaLiga standings s?hif?si il? h?r ?eyi bil. LaLiga canl? futbol h?v?skarlar?n?n seçimi. LaLiga logo dizayn? h?r il yenil?nir. ?n aktual xal c?dv?li üçün [url=https://laliga.com.az/]https://laliga.com.az[/url] bölm?sin? bax?n. LaLiga bombardirl?r siyah?s? yenil?ndi. LaLiga fixtures 2022/23 v? 2025 siyah?s?. LaLiga stats h?r mövsüm yenil?nir. LaLiga cup final? böyük maraqla izl?nir. Futbol azarke?l?ri üçün LaLiga livescor

5th October 2025

laligaaz

dazn laliga

?spaniya futbolunun ritmini hiss et. ?spaniya çempionat?n?n xal durumu daim yenil?nir. ?spaniya LaLiga canl? futbolunu qaç?rmay?n. LaLiga logo 2020 il? 2025 aras?ndak? f?rql?ri gör. Futbol günd?mini izl?m?k üçün [url=https://laliga.com.az/]laliga table today[/url] s?hif?si kifay?tdir. LaLiga goal record yenid?n d?yi?di. LaLiga tv canl? baxmaq üçün seçiml?r. LaLiga statistika s?hif?sind? komanda göst?ricil?ri. All LaLiga winners tarixi maraql?d?r. LaLiga live score il? heç bir matç

5th October 2025

laligaaz

laliga cup

Canl? n?tic?l?r v? LaLiga puan durumu bir yerd?. LaLiga c?dv?lini izl?m?k ist?yirsinizs?, ?n son m?lumatlar buradad?r. ?spaniya LaLiga canl? futbolunu qaç?rmay?n. Loqodak? d?yi?iklikl?r brendin müasir ruhunu ?ks etdirir. Matç c?dv?lini izl?m?k üçün sad?c? [url=https://laliga.com.az/]laliga.com.az[/url] sayt?na daxil olun v? t?qvimi yoxlay?n. LaLiga bombardirl?r siyah?s? yenil?ndi. LaLiga 24/25 t?qvimi art?q haz?rd?r. LaLiga tak?mlar? aras?nda r?qab?t yüks?kdir. LaLiga kupas? u?runda

5th October 2025

socceraz

soccer 365

iOS üçün soccer yükl?yib pulsuz oynay?n. Mini soccer star mod apk futbol oynamaq üçün ?la seçimdir. ?lav? m?lumat üçün [url=https://soccer.com.az/]http://soccer.com.az/[/url] s?hif?sin? baxmaq olar. Soccer random oyunu sad? v? ?yl?nc?lidir. Pro soccer online multiplayer h?v?skarlar? üçün uy?undur. World soccer champs apk para hilesi il? ?lav? resurs ?ld? edin. Soccer stream vasit?sil? canl? oyun izl?m?k mümkündür. Soccer manager 2025 hile il? ?lav? imkanlar mövcuddur. Soccer live score il?

3rd October 2025

socceraz

dream league soccer 2016

Android üçün ?n yax?? soccer t?tbiqini s?nay?n. Dream league soccer oyunu g?ncl?r aras?nda çox m??hurdur. ?lav? m?lumat üçün [url=https://soccer.com.az/]http://soccer.com.az/[/url] s?hif?sin? baxmaq olar. World soccer champs mod apk il? ?lav? imkanlar ?ld? edin. Pro soccer online multiplayer h?v?skarlar? üçün uy?undur. Soccer guru t?tbiqi il? futbol bilikl?rinizi art?r?n. Soccer skills champions league il? yeni bacar?qlar öyr?nin. Dream league soccer 2016 köhn? versiya sev?nl?r üçün uy?und

3rd October 2025

socceraz

globe soccer awards

Soccer oyununda komandalar seçm?k çox asand?r. Dream league soccer oyunu g?ncl?r aras?nda çox m??hurdur. Real futbol t?crüb?si üçün ?n do?ru seçim [url=https://soccer.com.az/]http://soccer.com.az/[/url] linkidir. World soccer champs mod apk il? ?lav? imkanlar ?ld? edin. Pro soccer online multiplayer h?v?skarlar? üçün uy?undur. Real soccer 2012 nostalji sev?nl?r üçün uy?undur. Globe soccer awards beyn?lxalq s?viyy?d? tan?n?r. Fifa soccer mod apk team2earn futbolu daha real edir. Reddit socc

3rd October 2025

socceraz

world soccer champs hile apk

Soccer oyununda qrafika v? animasiyalar çox reald?r. Soccer skills euro cup il? bacar?qlar?n?z? art?r?n. Futbol x?b?rl?rinin toplan?ld??? ?sas yer [url=https://soccer.com.az/]www.soccer.com.az[/url] say?l?r. Major league soccer standings n?tic?l?rini h?r gün yoxlay?n. Soccer star oyunçular üçün motivasiyaedici seçimdir. Soccer bros multiplayer futbol üçün ?la seçimdir. Soccer stream vasit?sil? canl? oyun izl?m?k mümkündür. Fifa soccer mod apk team2earn futbolu daha real edir. Reddit soccer

3rd October 2025

Vivamaxwin Focus

https://vivamaxwin1.ph/

I appreciated the thoughtful tone of this post. Even with a different perspective, it gave me something valuable to consider. Learn more at Vivamaxwin.

2nd October 2025

formula

formula 1 cars

Bak? Formula 1 biletl?ri il? ba?l? ?n s?rf?li t?klifl?ri ara?d?r?n. Formula 1 üçün ?n yax?? bilet seçiml?rini tapmaq mümkündür. Könüllü proqram? il? ba?l? ?trafl? m?lumat ? [url=https://formula-1.com.az/]formula 1 volunteer 2025[/url]. Formula 1 standings il? komandalar?n durumu haqq?nda fikir. Formula 1 cars modell?rinin qiym?tl?ri v? xüsusiyy?tl?ri. Formula 1 drivers siyah?s? daim d?qiql??dirilir. Formula 1 2025 Baku m?rh?l?si bar?d? ?n son x?b?rl?r. Formula 1 movie izl?yicil?r üçün ?

1st October 2025

formula

formula 1 baku 2024

Formula 1 2025 t?qvimini öyr?nm?k ist?y?nl?r üçün faydal? m?lumat. Formula 1 sürücül?ri haqq?nda maraql? faktlar. Formula 1 bar?d? h?r ?ey burada ? [url=https://formula-1.com.az/]www.formula-1.com.az[/url]. Formula 1 canli yay?m üçün yeni platformalar. Formula 1 Bak? 2024 biletl?ri onlayn ?ld? oluna bil?r. Formula 1 haqq?nda maraql? tarixi faktlar. Formula 1 haqq?nda ?n çox veril?n suallar. Formula 1 movie izl?yicil?r üçün ?yl?nc?li seçimdir. Formula 1 logo simvolikas?n?n m?nas? bar?d?

1st October 2025

formula

formula 1 car

Formula 1 könüllü proqram? haqq?nda maraql? m?lumatlar burada. Formula 1 Bak?da 2025 tarixl?rini indi öyr?nin. M?lumat üçün buraya klikl?yin ? [url=https://formula-1.com.az/]formula 1 com az[/url]. Formula 1 volunteer 2025 proqram?na qo?ulmaq üçün ??rtl?r. Formula 1 izl?m?k üçün mobil t?tbiql?rin üstünlükl?ri. Formula 1 izl?m?k üçün ?n yax?? saytlar. Formula 1 tickets almaq üçün s?rf?li variantlar. Formula 1 Bak? 2024 n? zaman keçiril?c?k. Formula 1 2025 Baku üçün t?qvim yenil?nib.

1st October 2025

Z7Live1 Horizon

https://z7live1.ph/

I really enjoyed how this post breaks down the topic in a simple way. I see it a bit differently, but that’s what makes discussions interesting. Learn more at Z7Live1.

1st October 2025

luckyneko

lucky neko demo gratis

pg lucky neko xüsusiyy?tl?ri h?qiq?t?n maraql?d?r. Tamamil? pulsuz s?nay?n: [url=https://lucky-neko.com.az/]demo lucky neko gratis[/url]. lucky neko casino onlayn seçim üçün ?lveri?lidir. lucky neko slot demo yeni oyunçular üçün uy?undur. pg soft demo lucky neko say?sind? risksiz s?naq mümkündür. R?smi giri?: [url=https://lucky-neko.com.az/]www.lucky-neko.com.az sayt[/url]. maneki neko donkey lucky cat simvolu ??nlik qat?r. slot demo lucky neko keyfiyy?tli animasiyalara malikdir. pg soft lucky

30th September 2025

luckyneko

lucky neko slot

lucky neko free play versiyas? t?crüb? üçün ideald?r. ?n maraql? demo üçün keçid: [url=https://lucky-neko.com.az/]pg soft lucky neko[/url]. como jogar lucky neko çox sad?dir. slot demo lucky neko il? m??q ed? bil?rsiniz. lucky cat maneki neko tattoo maraql? görünür. R?smi sayt? buradan aç?n: [url=https://lucky-neko.com.az/]https://lucky-neko.com.az/[/url]. slot lucky neko demo ?yl?nc? üçün ?lad?r. slot demo lucky neko keyfiyy?tli animasiyalara malikdir. maneki neko lucky cat q?dim ?n?n?l?rd?n

30th September 2025

luckyneko

lucky neko minutos pagantes